Why Crypto Investments Require Extra Caution

Looking for crypto investment tips? Here are the essentials:

- Only invest what you can afford to lose (max 5% of portfolio)

- Use dollar-cost averaging instead of lump sums

- Do your own research (DYOR) before buying any token

- Focus on established cryptocurrencies first (Bitcoin, Ethereum)

- Secure your assets in hardware wallets or trusted custodians

- Understand tax implications before trading

- Beware of scams and influencer hype

The cryptocurrency market offers both tremendous opportunity and significant risk. Crypto investment tips are essential for anyone venturing into this volatile asset class where prices can swing 20% in a single day. Unlike traditional markets that close, crypto trades 24/7, creating a landscape where fortunes can be made or lost while you sleep.

The reality is stark: 71% of retail clients lose money when trading crypto CFDs, according to industry data. This isn’t surprising when you consider there are over two million different cryptocurrencies in existence, many with questionable utility or backing.

Yet despite the risks, cryptocurrency continues to attract investors seeking potential returns beyond traditional markets. Bitcoin has weathered multiple 50%+ crashes only to reach new highs, demonstrating remarkable resilience for those with patience and discipline.

The key to survival? Knowledge, caution, and a strategic approach.

“Without risk, there are no profits,” as experienced investors say. But understanding how to manage that risk makes all the difference between a painful learning experience and building wealth in this emerging asset class.

Most financial experts recommend limiting crypto exposure to less than 5% of your total portfolio due to its high-risk nature. This creates a boundary for potential losses while still allowing participation in potential upside.

10 Must-Know Crypto Investment Tips

Let’s face it—crypto investing isn’t about getting lucky with a moonshot coin. It’s about playing the long game with strategy and smarts.

The crypto market dances to its own rhythm, often following Bitcoin’s four-year halving cycles that dramatically affect supply and demand. These cycles create predictable (though never guaranteed) waves of expansion and contraction. When you understand these patterns, you’re less likely to buy during euphoric highs or panic-sell during scary lows.

Think of crypto as the wild west of your investment frontier—exciting, but requiring extra vigilance. That’s why having a solid framework matters more than picking the “next Bitcoin.”

Portfolio theory isn’t just for Wall Street—it applies perfectly to crypto. Spreading your bets across different types of assets helps cushion the inevitable volatility. When one coin takes a nosedive, another might be soaring.

Risk management is your safety net in this high-wire act. Without it, you’re essentially gambling rather than investing. The most successful crypto investors I’ve met aren’t the ones making wild bets—they’re the ones who protect their downside first.

Perhaps most importantly, a long-term mindset separates the winners from the losers in this space. The day-to-day price movements can drive you crazy if you watch too closely. Zoom out, and suddenly those terrifying dips look like minor bumps on an upward journey.

As we explore these essential crypto investment tips together, remember we’re not chasing overnight millions. We’re building sustainable wealth while protecting what you’ve already worked hard to earn. The crypto market rewards patience and punishes impulsiveness—a lesson many learn the expensive way.

Let’s explore the practical rules that will help you steer these exciting but choppy waters with confidence.

Rule #1 – Only Invest What You Can Afford to Lose

Think of cryptocurrency investing like walking into a casino – except with better odds and more homework. The first and most critical crypto investment tip is brutally simple: never risk money you can’t stand to lose completely.

Even Bitcoin and Ethereum – the market giants – have plummeted over 50% multiple times throughout their history. These dramatic swings can happen breathtakingly fast, sometimes overnight.

“I’ve seen too many people mortgage their homes or take out loans to buy crypto at market peaks,” says veteran crypto investor Mark Thompson. “When prices crashed, they were forced to sell at massive losses because they needed the money for living expenses.”

This creates a devastating financial double-whammy: not only do you lose your investment, but you might also end up in debt or unable to pay essential bills.

Before you dive into crypto, make sure you’ve checked these crucial boxes:

- Your emergency fund covers 3-6 months of expenses

- You’ve tackled high-interest debt

- This money won’t be needed for any planned expenses in the next 3-5 years

- You’ve mentally prepared to lose the entire investment (while working to prevent that)

The psychology of investing becomes particularly tricky with cryptocurrency. The sunk-cost fallacy – that temptation to throw good money after bad – hits differently when you’ve watched a coin skyrocket before crashing. There’s always that nagging thought: “If I invest more now at these lower prices, I’ll make it all back when it rebounds!”

That thinking has led countless investors down a dangerous path. According to scientific research, Americans lost a staggering $5.6 billion to crypto scams in 2023 alone – a 45% increase from the previous year. Many victims were trying to recoup previous losses, making them vulnerable to promises of quick returns.

Emotional control becomes your superpower in crypto markets. When you’re only investing what you can truly afford to lose, you make clearer decisions. You can hold through terrifying dips or even buy more at discounted prices because you’re not driven by panic or desperation.

This rule isn’t about limiting your potential gains – it’s about ensuring you’ll still be in the game tomorrow, regardless of what happens today.

Rule #2 – Cap Crypto to 5% (or Less) of Your Portfolio

When it comes to building your investment portfolio, how you divvy up your money might be the single most important decision you’ll make. For most of us – especially if you’re just dipping your toes into the crypto waters – keeping your cryptocurrency investments to 5% or less of your total portfolio is a smart move.

“Start small and get comfortable” is the advice I’ve seen work best for newcomers. Many financial advisors I’ve spoken with actually suggest an even more conservative 1-2% allocation for first-timers. This approach gives you a chance to experience those exciting potential gains while protecting your financial future from crypto’s notorious roller-coaster price movements.

I’ve found the barbell strategy particularly effective for my own crypto investing:

Think of it like this: keep about 75-90% of your crypto money in established assets like Bitcoin and Ethereum (the “safe” end of your barbell), then allocate just 10-25% toward carefully researched smaller projects that might have bigger growth potential (the “risky” end). This way, you’re not betting the farm on unproven projects.

Before you consider increasing your allocation, try this simple mental exercise: “How would I feel if my crypto investments suddenly dropped 50% in value next week?” Be honest with yourself. If your answer involves significant stress, sleepless nights, or worse – actual financial hardship – your position is probably too large.

Regular rebalancing is your friend here. When your crypto performs exceptionally well (and yes, those days do happen!), consider taking some profits off the table and moving them to other asset classes. When prices drop and your research still indicates long-term value, you might gradually increase your position.

Diversification across different asset classes – stocks, bonds, real estate, and yes, a small slice of crypto – provides the foundation for long-term wealth building. The 5% guideline creates a safety net that lets you participate in crypto’s potential upside while ensuring a bad day in the markets won’t derail your entire financial future.

Rule #3 – Use Dollar-Cost Averaging (DCA)

The rollercoaster of crypto prices can make anyone’s stomach drop. That’s where dollar-cost averaging comes in – it’s like wearing a seatbelt for your crypto journey.

Instead of diving in headfirst with all your money, DCA lets you wade in gradually. It’s one of the most practical crypto investment tips you’ll ever receive, especially if market volatility makes you nervous.

Here’s how it works: rather than dropping $6,000 on Bitcoin in one go, you might invest $500 each month for a year. This approach is like steadily filling a bucket instead of trying to catch a waterfall.

The beauty of DCA is that it works with your psychology, not against it. When prices drop, your regular investment buys more coins. When prices rise, you’re already holding some assets that are gaining value. Either way, you win some peace of mind.

“The biggest advantage of dollar-cost averaging is that it removes emotion from the equation,” says crypto educator Sarah Chen. “You’re no longer trying to time the market – you’re giving yourself time in the market.”

Consider what happened between 2021 and 2024: Bitcoin climbed to $60,000, plummeted to around $17,000, then rebounded to set new records. Investors who used DCA throughout this wild ride generally fared much better than those who went all-in at the wrong time.

The best part? You can automate the whole process. Most reputable exchanges let you set up recurring purchases – weekly, bi-weekly, or monthly. Set it up once and let the system work for you. This “set and forget” approach prevents the impulse to make hasty decisions based on market headlines or social media hype.

During bear markets, DCA really shines. While others are paralyzed by fear, your automated strategy keeps accumulating assets at bargain prices. Think of it as shopping the clearance sale that others are too scared to enter.

While research shows lump-sum investing can outperform DCA during steady bull markets, crypto rarely gives us such predictable conditions. In the volatile world of digital assets, the smoothing effect of regular, disciplined buying typically delivers better long-term results – and definitely better sleep at night.

Rule #4 – Do Your Own Research (DYOR) Before You Buy

In a world of crypto influencers promising “100x gems” and Twitter threads hyping the next big thing, your best defense is knowledge. Doing your own research isn’t just good advice—it’s your financial lifeline in the crypto ocean.

I remember when a friend jumped into a new DeFi token because a YouTuber called it “revolutionary,” only to watch it crash 90% a month later. The project had massive token allocations to early investors who dumped at the first opportunity—something he would have finded with just 30 minutes of research.

Effective research means digging beneath the surface of a project:

Whitepaper review should be your starting point. Does the project solve a genuine problem? Is the technical approach sound, or just buzzwords strung together? Most failed projects have whitepapers that read like science fiction rather than viable solutions.

Team credentials matter enormously. Who’s building this? Anonymous teams aren’t necessarily red flags (Bitcoin’s creator is unknown, after all), but they do require extra scrutiny. Look for relevant experience and track records of completing projects.

Tokenomics will determine a coin’s long-term value potential. What’s the total supply? How are tokens distributed? A project with 70% of tokens held by founders is structurally designed for dumping, not long-term growth.

On-chain data tells the truth when marketing lies. Are people actually using the network? Tools like Etherscan or Solscan show real transaction activity beyond the hype.

GitHub activity reveals whether development is active or abandoned. A project with few commits in the past months is usually a project in trouble.

Market metrics help you assess value. A project with a $500 million market cap but only 1,000 daily users is probably overvalued compared to one with similar usage but a $50 million valuation.

Crypto investment tips for effective DYOR

Smart research isn’t just about what you check, but how you approach it. Check security audits from reputable firms—they’re like health inspections for code. A project without audits is asking you to eat at a restaurant that’s never been inspected.

Always compare market cap against actual utility. A token worth billions should be solving billion-dollar problems or showing adoption to match. The gap between valuation and reality is where most investors get hurt.

Beware of sudden hype cycles. When everyone is suddenly talking about a project that was unknown last week, proceed with extreme caution. Organic growth builds gradually; overnight sensations are often manufactured.

Diversify your information sources beyond the project’s own channels. Reddit, Discord, and independent analysts often reveal problems the marketing team conveniently omits.

Verify partnerships independently. Many projects claim “partnerships” with major companies that turn out to be nothing more than using their publicly available APIs or attending the same conference.

“The louder someone shouts about guaranteed returns, the faster you should walk away,” as veteran crypto analyst Sarah Johnson wisely notes. “Real projects talk about technology and adoption—not price predictions.”

If you’re new to cryptocurrency fundamentals, our Crypto 101: A Beginner’s Guide to Understanding Cryptocurrency provides the foundation you need before making your first investment.

In crypto, your research quality directly impacts your financial outcomes. Take the time to do it right.

Rule #5 – Stick to Quality: Bitcoin, Ethereum & Select Altcoins

When you’re just starting out, one of the most valuable crypto investment tips I can share is pretty straightforward: begin with cryptocurrencies that have already proven themselves through multiple market storms.

There’s a good reason why Bitcoin and Ethereum together make up more than 60% of the entire cryptocurrency market:

These two heavyweights have earned their status the hard way. They’ve survived brutal market crashes that wiped out countless competitors. They’ve built the largest developer communities in the space. They’ve attracted serious institutional money that smaller projects can only dream about. And importantly for you as an investor, they offer the most liquid markets – meaning you can buy or sell without dramatically affecting the price.

For newcomers to crypto, I recommend putting 75-90% of your crypto budget into these established players. Think of them as your foundation – not necessarily the most exciting part of your portfolio, but the part that helps you sleep at night.

As your confidence and knowledge grow, you can start carefully exploring select altcoins. But be picky! When I evaluate smaller projects, I look for real substance:

Actual use cases matter enormously. Is this project solving a genuine problem, or is it a solution looking for a problem? The crypto landscape is littered with clever technology that nobody actually needed.

Active development is a must-check. I regularly peek at projects’ GitHub repositories – if nobody’s been updating the code for months, that’s a massive red flag.

Growing adoption tells you if real people find value in the project. Are transaction counts increasing? Is the user base expanding? Numbers don’t lie.

Transparent teams give me much more confidence. Anonymous developers might have legitimate reasons for privacy, but they also have less accountability.

I’ve learned the hard way to be extremely cautious with meme coins and hype-driven projects. Yes, they can deliver those eye-popping returns that make for great social media posts, but they can collapse just as dramatically, often leaving newer investors holding the bag.

Some emerging areas like decentralized finance (DeFi), NFTs, and AI-related crypto projects offer interesting growth potential. But remember – these cutting-edge sectors come with cutting-edge risks. They require deeper research and a stronger stomach for volatility.

The quality-first approach isn’t the most exciting strategy, but in the wild world of crypto, boring can be beautiful for your long-term financial health.

Rule #6 – Store Your Coins Safely (Hardware Wallets & Custody)

“Not your keys, not your coins” isn’t just a catchy phrase in the crypto world—it’s wisdom that could save your entire investment. How you store your digital assets might seem like a technical afterthought, but it’s actually one of the most crucial crypto investment tips you’ll ever receive.

When it comes to protecting your crypto, you essentially have two paths:

- Self-custody: You take full responsibility by controlling your private keys through hardware wallets, software wallets, or paper wallets.

- Custodial services: You trust a third party to hold your assets, similar to how traditional banks safeguard your money.

Both approaches have their merits and drawbacks:

| Feature | Self-Custody | Custodial Service |

|---|---|---|

| Control | Complete | Limited |

| Recovery options | Limited (seed phrase only) | Multiple (password reset, etc.) |

| Insurance | None | Often available |

| Technical knowledge required | High | Low |

| Vulnerability to hacks | Individual-level | Platform-level |

For serious investors with significant holdings, hardware wallets like Ledger or Trezor offer peace of mind that’s well worth their modest cost. These small physical devices keep your private keys completely offline, making them virtually immune to remote hacking attempts. Think of them as tiny, specialized vaults that only open up when physically connected to your computer.

Your seed phrase (those 12-24 recovery words) becomes your ultimate lifeline in self-custody. Lose it, and you’ve essentially thrown away your crypto forever—no customer service line to call, no recovery process. I’ve heard heartbreaking stories of early Bitcoin investors who can’t access millions because they lost their seed phrases.

Protect your seed phrase like the treasure map it truly is:

– Write it on paper or engrave it on metal (never store it digitally)

– Keep it in a secure location like a safe deposit box

– Never, ever share it with anyone—legitimate services will never ask for it

– Consider splitting storage across multiple secure locations for extra protection

Crypto investment tips for choosing storage solutions

The right storage approach depends on your comfort with technology and your investment size. Two-factor authentication adds an essential security layer to any exchange accounts you use. Before trusting a new wallet or exchange with large amounts, test small withdrawals first to verify everything works correctly.

For substantial holdings, consider multi-signature setups that require multiple approvals for transactions—like having a safety deposit box that needs two keys to open. If using custodial services, thoroughly evaluate their insurance coverage and security history.

“I split my holdings between self-custody for long-term investments and trusted exchanges for the portion I might trade,” shares Marco, a crypto investor since 2016. “Different storage solutions for different purposes.”

Security isn’t a one-time setup but an ongoing practice. For more detailed guidance on avoiding costly security mistakes, check out our guide on The Biggest Crypto Mistakes Beginners Make and How to Avoid Them.

Rule #7 – Manage Risk with Diversification & Rebalancing

Let’s talk about something that might sound boring but could save your crypto portfolio—diversification and rebalancing. Think of it as not putting all your eggs in one digital basket!

Diversification works on multiple levels in the crypto world:

First, consider your entire investment universe. Crypto should be just one piece of your financial puzzle alongside stocks, bonds, real estate, and other assets. This cross-asset spread helps ensure that a crypto winter won’t freeze your entire financial future.

Within your crypto allocation, spreading investments across different types of projects creates another safety net. I like to think of it as building a crypto dream team, where each player has a specific role:

Bitcoin serves as your digital gold—a store of value and inflation hedge. Ethereum functions as your ecosystem backbone, powering countless applications and services. Stablecoins provide a safe harbor during market storms while potentially earning yield. DeFi tokens give you exposure to the world of decentralized finance. And infrastructure tokens let you bet on the solutions that will help blockchain technology scale to serve billions of users.

But diversification alone isn’t enough. Your portfolio needs regular maintenance through rebalancing.

Here’s what happens without rebalancing: Let’s say you start with 50% Bitcoin and 50% Ethereum. After a huge Bitcoin rally, you might end up with 70% Bitcoin and 30% Ethereum—far more Bitcoin-heavy than you intended. By selling some Bitcoin to buy more Ethereum, you’re essentially taking profits from winners and buying assets at relative discounts.

This take-profit discipline is crucial in crypto’s wild west environment. Consider setting specific targets: “If Asset X grows to Y% of my portfolio, I’ll sell some to rebalance.” This removes emotion from the equation when prices are skyrocketing and FOMO (fear of missing out) kicks in.

Many experienced crypto investors use technical and on-chain indicators to inform these rebalancing decisions. Moving averages help identify trends, while the Relative Strength Index (RSI) can spot potential reversals. On-chain metrics like active addresses and transaction volume provide insights into actual blockchain usage beyond price movements.

The beauty of regular rebalancing is that it creates a systematic approach to the investor’s holy grail: buying low and selling high. Rather than trying to time market tops and bottoms (which is nearly impossible), you’re consistently taking some chips off the table when they’ve multiplied and reinvesting where there might be future growth potential.

In crypto’s volatile environment, having a structured approach to risk management isn’t just nice to have—it’s essential for long-term survival and success.

Rule #8 – Understand Taxes & Regulations Upfront

The tax implications of crypto might not be the most exciting topic, but it’s one of the most essential crypto investment tips you’ll ever receive. Trust me—ignoring this part can turn your profitable investments into a nightmare faster than a Bitcoin flash crash.

In the United States, the IRS considers cryptocurrencies as property, not currency. This seemingly small distinction creates a world of tax complications:

Every time you sell Bitcoin, swap ETH for a different token, or even buy a coffee with crypto, you’ve created a taxable event. Yes, really! That impulse trade you made at 2 AM? The IRS would like a word.

Your tax rate depends on how long you’ve held your crypto before selling. Hold for less than a year, and you’ll pay higher short-term capital gains rates (your ordinary income tax rate). Hold for over a year, and you’ll benefit from lower long-term capital gains rates—potentially saving thousands depending on your tax bracket.

There is a silver lining, though. Your crypto losses can offset your gains, which might help reduce your tax bill during those inevitable market downturns. Just be aware of limitations on how much you can deduct.

“I had a client who made over 500 trades in a year without keeping records,” shares Sarah, a crypto tax specialist. “We spent weeks reconstructing his transaction history. He ended up owing thousands more than expected, plus the cost of professional help.”

Don’t be that person. Specialized crypto tax software like CoinTracker, Koinly, or TaxBit can automatically track your transactions across different platforms and generate the reports you’ll need. Even if you’re only making occasional trades, these tools are worth every penny come tax season.

Tax rules vary dramatically between countries. While Portugal has historically been crypto-friendly, countries like India have implemented specific crypto taxes. Research your local regulations or, better yet, consult with a tax professional who understands digital assets.

The regulatory landscape is also constantly shifting. What’s permitted today might be restricted tomorrow. Stay informed about:

- New legislation affecting cryptocurrency ownership

- Actions from regulatory agencies like the SEC or their equivalent in your country

- Global developments that could impact markets worldwide

According to research on regulation impact, clear regulatory frameworks actually help legitimize cryptocurrency markets and reduce volatility over time.

Keep detailed records of all your transactions, including dates, amounts, and the dollar value at the time of each transaction. Screenshot confirmation screens if needed. Your future self will thank you when tax season arrives or if you face an audit.

Remember—tax compliance isn’t optional. It’s a fundamental part of responsible crypto investing that can save you significant stress, penalties, and possibly even legal troubles down the road.

Rule #9 – Guard Against Scams, FOMO & Influencer Hype

The crypto space is unfortunately rife with scams and misleading information. Understanding common threats can help protect your investments.

According to FBI statistics, Americans lost $5.6 billion to crypto scams in 2023, a 45% increase from 2022. Common scams include:

- Pump-and-dump schemes: Orchestrated price manipulation followed by mass selling

- Fake airdrops and giveaways: Promises of free tokens that require you to send coins first

- Phishing attacks: Fake websites and emails designed to steal login credentials

- Rug pulls: Developers abandoning projects after raising funds

- Social engineering: Direct messages offering “investment opportunities”

Social media influencers often contribute to market manipulation. Research analyzing 36,000 tweets from 180 top crypto influencers found:

– Initial positive returns of 1.83% on the first day after influencer tweets

– Returns turning negative by day 5 (-1.02%)

– Average 30-day return of -7.9% (annualized to -62.8%)

The Fear & Greed Index can help gauge market sentiment and identify periods of excessive optimism or pessimism. Extreme readings often signal potential market reversals.

Crypto investment tips to avoid scams

- Verify URLs carefully: Ensure you’re on legitimate websites before connecting wallets.

- Never share seed phrases: No legitimate project or support team will ask for these.

- Use official channels: Download apps only from official sources.

- Be skeptical of guaranteed returns: If it sounds too good to be true, it probably is.

- Research before investing: Check multiple sources beyond the project’s marketing.

For more detailed guidance on avoiding common pitfalls, see our comprehensive guide on The Biggest Crypto Mistakes Beginners Make and How to Avoid Them.

Rule #10 – Plan Your Exit and Converting Crypto Back to Cash

The journey into crypto doesn’t end with buying – yet surprisingly, many investors spend all their energy on purchase strategies while completely overlooking how they’ll eventually cash out. This oversight can be costly!

Having a thoughtful exit plan is just as important as your buying strategy. Think of it as planning both your entrance and exit when you walk into a building – you need both to complete the journey successfully.

Liquidity matters tremendously when converting crypto back to traditional currency. Bitcoin and Ethereum can typically be sold in large amounts without dramatically affecting their price. However, if you try selling a significant position in a smaller altcoin all at once, you might trigger a mini price crash – directly hurting your returns.

Instead of dumping everything at once, consider a more measured approach. Staggered selling allows you to convert portions of your holdings over time, reducing your exposure to short-term price swings and potentially securing better average prices. It’s the reverse of dollar-cost averaging – call it dollar-cost exiting!

Many experienced investors use stablecoins as an intermediate step. Converting your crypto to stablecoins like USDC or USDT first gives you breathing room to plan your next move without worrying about price volatility while you arrange bank transfers.

Don’t forget about taxes! Tax-efficient harvesting means timing your sales strategically to optimize tax implications. For instance, you might offset gains by selling some losing positions in the same tax year, or hold assets long enough to qualify for lower long-term capital gains rates.

I always recommend maintaining accounts on multiple exchanges – what I call exchange diversification. This creates redundancy in case one platform experiences technical issues or freezes withdrawals during high-volume periods (which has happened before!).

Here’s a practical tip: before you actually need to cash out a significant amount, run a test withdrawal with a small sum. This helps you understand the entire process, including exchange withdrawal limits, how long bank transfers really take, what verification steps might be required, and the total fees you’ll pay along the way. Better to learn these lessons with $50 than with your entire portfolio!

Keep detailed records of everything. Document purchase dates and prices, sale dates and prices, fees paid, and transfer details between wallets or exchanges. These records aren’t just for tax purposes – they help you evaluate your investment performance and improve your strategy over time.

Finally, create what I call an emergency sell plan. Decide in advance which assets you would sell first if you needed to liquidate quickly, and which exchanges you would use. Having this plan ready means you won’t be making these critical decisions under the stress of a market crisis.

A complete crypto strategy isn’t just about getting in – it’s about knowing how and when to get out. Crypto investment tips that ignore exit planning are only telling half the story!

Frequently Asked Questions about Crypto Investing

How much of my total portfolio should be in crypto?

If you’re wondering about the right crypto allocation, you’re not alone. Most financial experts recommend keeping your crypto exposure to no more than 5% of your total investment portfolio. If you’re just getting started, consider dipping your toes with just 1-2% until you’ve weathered a few market cycles and understand how volatility feels firsthand.

Your personal comfort level matters tremendously here. Think about your specific situation:

Are you naturally risk-averse or comfortable with big swings? Do you have decades until retirement or just a few years? Are you investing for growth or stability? How’s your overall financial health looking? And most importantly, how well do you actually understand what you’re buying?

The beauty is that even a small 1-2% allocation can give you meaningful exposure to crypto’s potential upside while protecting your financial foundation. This is a high-risk, potentially high-reward asset class – you want to participate without putting your financial future at risk.

Should I consider trading instead of long-term investing?

The allure of trading is powerful – those stories of overnight crypto millionaires are certainly tempting! But before you dive into the trading waters, understand what you’re signing up for.

Trading demands an extraordinary commitment. You’ll need to constantly monitor markets (goodbye, sleep), maintain iron emotional discipline when thousands of dollars swing up and down, develop sophisticated technical knowledge, steer complex tax situations, and compete against professional traders with powerful algorithms and years of experience.

The sobering reality? Research consistently shows most retail traders lose money. One eye-opening study found that 71% of retail client accounts lose money when trading crypto CFDs. That’s not a coin flip – those are genuinely tough odds.

For most of us, especially beginners, a long-term buy-and-hold strategy with periodic rebalancing simply works better. It aligns with how most successful wealth is built – gradually, with discipline, and without requiring you to become a full-time market analyst. You’ll likely see better returns while preserving your time, energy, and emotional wellbeing.

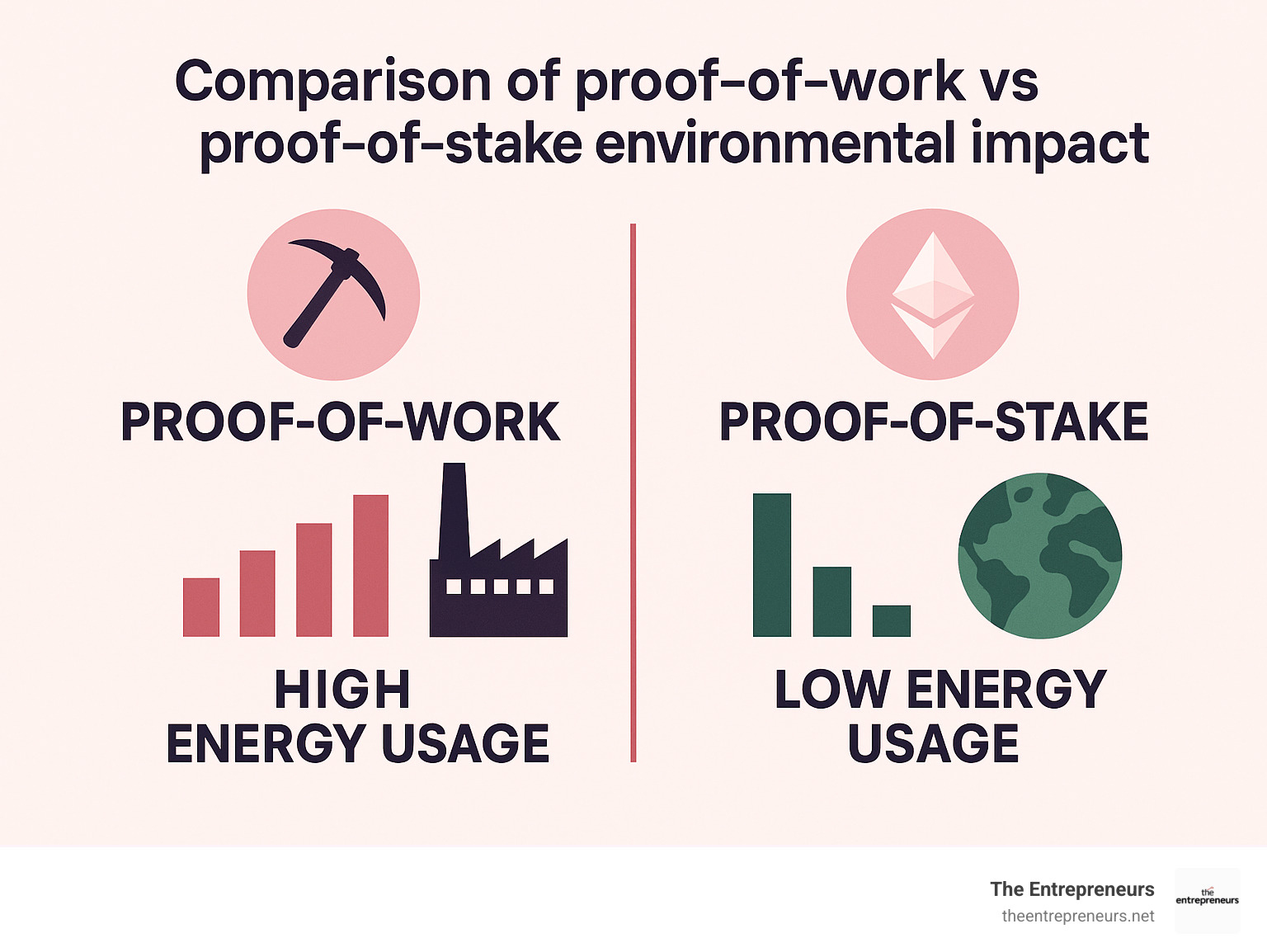

What are the environmental impacts of proof-of-work coins?

The environmental question has become increasingly important for many crypto investors, and with good reason. The energy footprint varies dramatically depending on how a cryptocurrency validates transactions:

Proof-of-Work (PoW) networks like Bitcoin require significant energy for mining operations. To put it in perspective, Cambridge researchers estimate Bitcoin mining alone consumes more electricity than all U.S. residential lighting combined – more than twice as much, actually. That’s a substantial footprint.

Proof-of-Stake (PoS) networks like Ethereum (since its 2022 upgrade) and many newer cryptocurrencies operate much more efficiently. Instead of solving complex puzzles with powerful computers, PoS systems validate transactions through coin staking. The energy difference is staggering – PoS networks typically use about 99.9% less energy than comparable PoW systems.

The conversation is nuanced, though. Many Bitcoin mining operations are increasingly powered by renewable energy sources or use energy that would otherwise be wasted. And when evaluating environmental impact, it’s worth considering the value and utility these networks provide compared to traditional financial systems.

If environmental concerns are important to you, you might focus your investments on PoS cryptocurrencies or those with verified carbon-neutral operations. Your investment choices can align with your values.

Conclusion

Cryptocurrency investing offers tremendous potential for those who approach it with knowledge, discipline, and realistic expectations. By following these crypto investment tips, you can steer this volatile market while protecting your financial wellbeing.

Remember the core principles:

– Only invest what you can afford to lose

– Maintain appropriate portfolio allocation

– Use dollar-cost averaging to manage volatility

– Do thorough research before investing

– Focus on quality projects with proven track records

– Secure your assets properly

– Diversify and rebalance regularly

– Understand tax and regulatory requirements

– Guard against scams and hype

– Plan your exit strategy in advance

The crypto market will continue to evolve, with new opportunities and challenges emerging regularly. Continuous learning is essential for long-term success.

At TheEntrepreneurs.net, we’re committed to providing ongoing education and resources to help you steer the cryptocurrency landscape. For more insights and guidance, explore our Money & Crypto resources.

Investing in cryptocurrency is a marathon, not a sprint. The most successful investors are those who maintain discipline through market cycles, continuously refine their strategies based on new information, and never lose sight of their long-term financial goals.